虚拟货币,尤其是比特币,近年来已成为全球金融市场上最受关注的主题之一。自2009年比特币问世以来,这种数字资产逐渐引起了公众、投资者及政府的高度注意。虚拟货币不仅在投资领域掀起了波澜,还是科技、经济、法律等多个领域亟待研究的重要课题。

本文将全面探讨虚拟货币,特别是比特币的起源、运行机制、市场表现,以及其对全球金融市场的影响,旨在为读者提供一个清晰的理解框架。同时,我们还将讨论一些相关的问题,以更深入地了解这一新兴事物。

虚拟货币起源于互联网的演变。2008年,一个名为中本聪的匿名个体发布了一篇名为《比特币:一种点对点的电子现金系统》的白皮书,提出了比特币的概念。比特币的诞生旨在创造一种独立于中央银行和政府的货币体系,这种货币以去中心化的方式运作,允许用户直接进行交易,无需中介机构。

随着技术的发展,越来越多的虚拟货币应运而生,如以太坊、莱特币、瑞波币等。这些虚拟货币各有其独特的特性,采用不同的技术架构,比如以太坊支持智能合约功能,而莱特币则被视为比特币的“轻量版”。然而,比特币依然是市场上最受欢迎和人气最高的虚拟货币。

比特币运作的核心技术是区块链。区块链是一种去中心化的分布式账本技术,其数据记录是不可篡改的,这确保了比特币交易的安全性和透明性。每当用户进行交易时,这笔交易信息会被打包成一个“区块”,并与前一个区块链连接,形成一个链式结构。

比特币网络上的交易是通过矿工来验证的。矿工利用计算机运算能力解决复杂的数学问题,从而验证交易并将新区块添加到区块链中。为此,他们会收到比特币作为奖励。这种工作机制被称为“工作量证明”(Proof of Work)。该过程不仅确保了交易的安全性,还控制了比特币的总供应量,以防止通货膨胀。

比特币及其他虚拟货币的市场动态受到多种因素的影响,包括市场需求、投资者情绪、技术发展和政策法规的变化。自2020年以来,随着全球对数字资产的认可度提高,比特币的价格经历了几轮显著的上涨,吸引了大量机构和个人投资者。

投资比特币的机会与风险并存。尽管许多投资者以高回报而受到吸引,但比特币价格波动极大,投资也面临不小的风险。因此,了解市场动态、进行充分的研究和分析是至关重要的。

虚拟货币的兴起还引发了诸多法律和监管问题。各国对于虚拟货币的态度各不相同,有的国家积极支持其发展,而有的国家则采取限制措施。在中国,银行和金融机构被禁止提供虚拟货币相关服务,而在美国,监管机构正在努力制定明确的规则来指导虚拟货币市场的发展。

这种监管环境的变化直接影响着虚拟货币市场的稳定性和投资者的信心。因此,投资者在进入这个市场前,应当仔细研究相关法规并保持关注最新的发展动态。

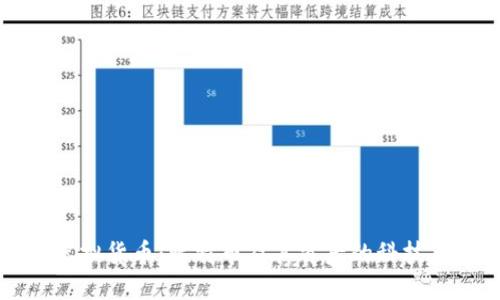

虚拟货币的未来发展还面临着诸多挑战与机遇。随着科技的不断进步,比特币及其他虚拟货币也在不断演变。预计未来几年内,随着区块链技术的进一步应用和完善,虚拟货币将会越来越普及,特别是在国际支付、资产管理等领域,虚拟货币会发挥重要的作用。

然而,虚拟货币的路途依然布满荆棘。技术的安全性、法律的合规性、市场的波动性等问题仍需要不断被解决。只有在一个规范有序的市场环境下,虚拟货币的真正潜力才能被发挥出来,才能为未来的全球经济发展增添动力。

比特币 often being referred to as "digital gold" due to its limited supply and store of value properties. Unlike fiat currencies, which can be printed in unlimited quantities, the total supply of Bitcoin is capped at 21 million coins. This scarcity mimics that of gold, presenting Bitcoin as a hedge against inflation and economic uncertainty.

The perception of Bitcoin as a digital gold is reinforced by its characteristics: it is easily transferable, divisible, and suitable for secure transactions. Investors seek refuge in Bitcoin during times of economic turbulence, much like how they would invest in physical gold. This function solidifies Bitcoin’s status and highlights its role as a legitimate asset class in portfolio diversification.

The legal and regulatory landscape surrounding cryptocurrencies is continuously evolving. Governments worldwide are grappling with the implications of these digital assets, striving to balance consumer protection, market integrity, and innovation. This ongoing discourse creates both opportunities and challenges for investors, entrepreneurs, and traders in the crypto space.

Investors should stay informed of the regulatory frameworks in their respective countries and the developing global standards. Compliance with regulations will be crucial as authorities aim to combat fraud, money laundering, and other illicit activities linked to cryptocurrencies. Ultimately, a transparent and well-regulated environment may enhance the legitimacy of cryptocurrencies and foster broader market participation.

Bitcoin is notorious for its price volatility, which can pose significant risks and rewards for investors. Factors contributing to this volatility include market sentiment, trading volume, macroeconomic trends, and regulatory news. Investors often find themselves reacting to price fluctuations, leading to emotional decision-making, which can exacerbate losses or gains.

Understanding the market dynamics and developing a personal investment strategy is vital for mitigating risks. Effective risk management practices, such as setting stop-loss orders, diversifying investments, and maintaining a long-term perspective, can help investors navigate the turbulent waters of the crypto market.

The debate over whether cryptocurrencies will replace traditional financial systems is multifaceted and ongoing. Advocates argue that the decentralized nature of cryptocurrencies can enhance financial inclusion, reduce transaction fees, and eliminate intermediaries. Innovations such as smart contracts on blockchain platforms can automate and streamline banking processes.

However, critics point to the scalability issues, regulatory challenges, and the current lack of consumer trust that may hinder cryptocurrencies from completely replacing traditional finance. It is likely that rather than outright replacement, we will see a coexistence of both systems, evolving whereby traditional banks may incorporate blockchain technology for improved efficiency and transparency.

总之,虚拟货币,特别是比特币,为传统金融体系带来了重大的创新和挑战。我们需要不断学习和适应这一变化,以准确把握其带来的机遇和潜在风险。在如今的经济环境中,智能的投资决策与对市场趋势的深入理解将助我们在虚拟货币的海洋中扬帆远航。

leave a reply